How Do Adjustable Rate Mortgages Work Fundamentals Explained

Attempt to discover a way to come up with 20%. You can't really get rid of the cost of mortgage insurance unless you refinance with some loans, such as FHA loans, however you can often get the requirement removed when you build up a minimum of 20% in equity. You'll need to pay various expenditures when you get a home loan.

Be wary of "no closing expense" loans unless you make certain you'll only remain in the home for a brief period of time since they can end up costing you more over the life of the loan.

Credit and security underwriting of FHA, VA, Standard, VA SAR, CDA, USDA and Portfolio home loan loans with a high degree of attention to detail.

Rumored Buzz on Reverse Mortgages How They Work

Acquiring realty can be a Check out this site tedious http://lanelrdj509.iamarrows.com/the-definitive-guide-to-what-will-happen-to-mortgages-if-the-economy-collapses and time-consuming process. Individuals with careers in the home loan industry look for to make the procedure as smooth as possible. Mortgage tasks most often need working with numbers and individuals. Some jobs need you to work straight with clients, while other tasks need you to work behind the scenes.

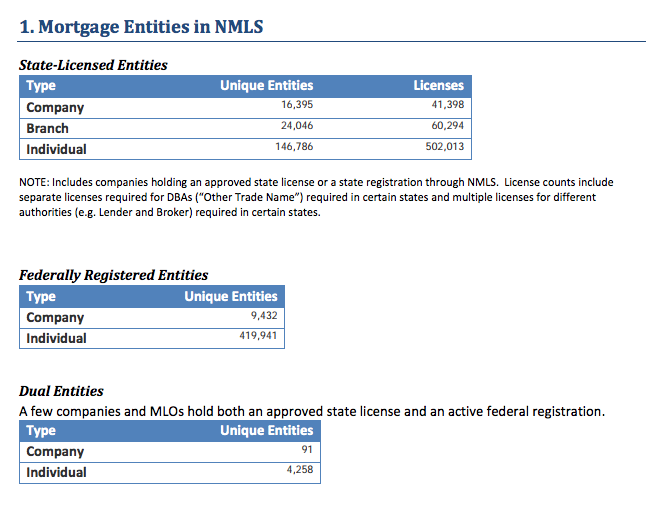

A home loan officer can operate in the domestic or business mortgage market. The majority of states need accreditation to work as a loan officer. The loan officer takes down the applicant's individual and monetary info and sends it to go through the underwriting process. Loan officers frequently direct candidates through the application process.

A home mortgage processor operates in tandem with loan officers and home mortgage underwriters. A processor is accountable for collecting all of the needed documentation to submit the loan application. They need to also validate that all files are finished according to the home mortgage business's requirements. Typical files gathered consist of credit appraisals and title insurance.

The Of How Does Interest Only Mortgages Work

Processors are frequently faced with due dates, resulting in a fast-pace workplace. Once a mortgage application is sent by a loan officer and received by a processor, it is then examined by a home loan underwriter, who makes the financial approval or denial decision. For instance, a home loan underwriter generally verifies a candidate's income by submitting the essential kinds.

Business may utilize handbook or automated underwriting procedures. According to a June 2010 short article by Sindhu Dundar of FINS, a financial profession site, analytical and excellent interaction abilities benefit those who want a career as a mortgage underwriter. Escrow officers are accountable for helping with the legal exchange of genuine estate property from one party to another.

The officer does not work on behalf of either party, but acts as a neutral 3rd party. Escrow officers obtain funds needed to complete the exchange and keeps them in an escrow account up until disbursement of the funds. Obtaining needed signatures, preparing titles and explaining escrow guidelines are the responsibility of the escrow officer.

How Do Mortgages And Down Payments Work Fundamentals Explained

Bureau of Labor Stats. On the low end, loan officers earned a 25th percentile wage of $45,100, suggesting 75 percent earned more than this amount. The 75th percentile salary is $92,610, implying 25 percent earn more. In 2016, 318,600 individuals were used in the U.S. as loan officers.

If you're not tethered to an employer and discover yourself hopping from task to task, there are lots of task titles you "appoint" yourself. Whether you call yourself a freelancer, temp worker, independent specialist it's all the very same term for a job that feeds the gig economy. Unsurprisingly, this widely-accepted method of work, which pleases a work-balance for millions of Americans, isn't disappearing anytime soon.

employees will be freelancers by 2020. According to NACo, the growth of the gig economy represents a change in the manner ins which Americans view what work means to them. Instead of working full-time for just one company, some workers choose to get in the gig economy for the versatility, flexibility and individual satisfaction that it offers.

9 Simple Techniques For How Do Mortgages Work With A Down Payment

There are 2 kinds of gig workers: "independent" and "contingent" employees. Independent employees are those who are genuinely their own employer. Contingent workers refer to individuals who work for another company or companies, just like routine staff members might, minus the security and all the other benefits that come with being a full-fledged staff member.

Because exact same Betterment research study, 40 percent of employees stated they feel unprepared to conserve enough to maintain their way of life during retirement. Gayle Schadendorf has been an independent graphic designer for 23 years and said that throughout her profession, she's worked practically specifically for one corporation. Nevertheless, due to business layoffs, she has lost her connections with art directors and hasn't worked for that business for a year.

" My work has actually reduced completely in the in 2015 due to the fact that there's really just one art director left that I had a decades-long relationship with. The climate has changed (how do reverse mortgages work?). When they need freelancers, they require them. When they do not, they don't." When it pertains to jobs like buying a house and conserving for retirement, are these even possible when you're a part of the gig economy? After all, when it pertains to getting a mortgage, freelancers can't whip out their W-2s and hand them to a lender as evidence of income.

Getting The How We Work Mortgages To Work

" I prepared ahead, had no financial obligation and an excellent mortgage lender, plus 2 years of income history," she says. It's a concise summary of her journey, which resulted in the purchase of her very first condo in Minneapolis and her second in San Diego. She said that her outstanding relationship with her home loan broker was essential to the process when she purchased her condo in Minneapolis.

The broker wanted evidence of future income as well. Schadendorf stated she currently had big contracts lined up with her employer and might reveal that she 'd have future contracts even after she closed on the property (obtaining a home loan and how mortgages work). Though a lending institution might look at "gig-ers" in a different way, there are some elements of getting a mortgage that stay the very same, no matter your job title.

It's an excellent concept to: Examine your credit. To ensure absolutely nothing is wrong, go to annualcreditreport. com, order your 3 complimentary credit reports and alert the credit score agency instantly if there are any concerns. You can also continuously monitor your credit by creating an account, here. The greater your credit rating, the more most likely it is that a lending institution will provide you cash for a home.

The Only Guide to Mortgages How Do They Work

This is special to those in the gig economy. Not surprisingly, you look riskier to a loan provider when you provide up 1099s instead of W-2s. Your loan provider wishes to be sure your earnings will remain constant in the future and that you can make your home mortgage payments. Save as much money as you can.

PMI is insurance that secures your loan provider in case you default on your mortgage. Premiums are usually paid regular monthly and differ from a portion of a percent to as much as 1. 5 percent of the worth of your loan. If you wish to show your guts follow this link as a reliable borrower, conserve much more than 20 percent.

Pre-approval might be a lot more crucial if you're a freelancer. It's an assurance from your lending institution that you're eligible to borrow a particular amount of cash at a specific rates of interest. Know what forms you need, consisting of W-2s, 1099s, bank declarations, 1040 tax returns, and so on. Be mindful of how reductions are seen.

More About How Common Are Principal Only Additional Payments Mortgages

REIGs are like small shared funds that buy rental residential or commercial properties. In a typical genuine estate investment group, a company purchases or develops a set of apartment or condo blocks or condominiums, then allows financiers to acquire them through the company, therefore joining the group. A single financier can own one or multiple systems of self-contained living space, but the business running the financial investment group collectively manages all of the units, dealing with upkeep, advertising vacancies, and speaking with occupants.

A standard realty investment group lease remains in the investor's name, and all of the systems pool a part of the lease to secure against occasional vacancies. To this end, you'll get some earnings even if your unit is empty. As long as the job rate for the pooled units does not surge too expensive, there ought to suffice to cover costs.

Home turning needs capital and the ability to do, or oversee, repair work as required. This is the proverbial "wild side" of property investing. Just as day trading is different from buy-and-hold investors, realty flippers stand out from buy-and-rent property managers. Case in pointreal estate flippers typically seek to successfully offer the undervalued sirius xm phone number to cancel properties they purchase in less than six months.

Therefore, the financial investment needs to already have the intrinsic value needed to make a profit with no modifications, or they'll remove the home from contention. Flippers who are unable to promptly discharge a home may find themselves in problem since they normally do not keep enough uncommitted cash on hand to pay the mortgage on a home over the long term.

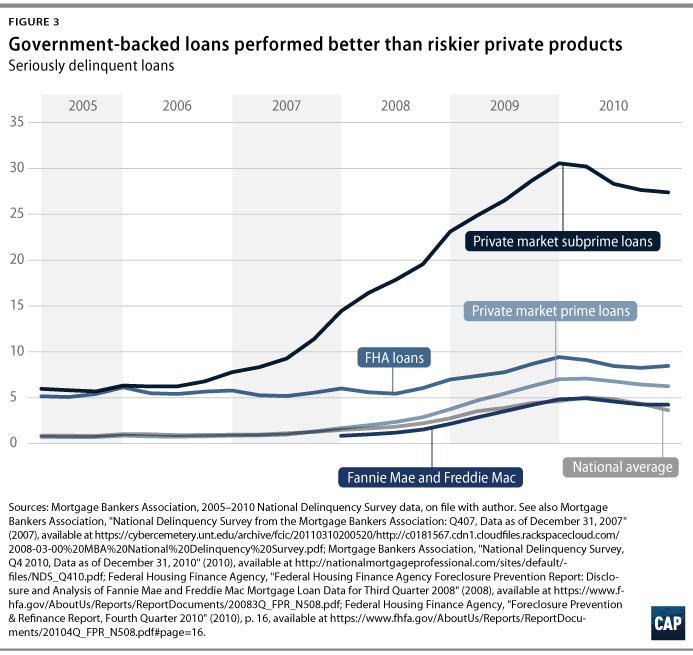

9 Easy Facts About How Subprime Mortgages Are Market Distortion Shown

There is another type of flipper who generates income by buying reasonably priced homes and adding value by remodeling them. This can be a longer-term investment, where investors can only afford to take on a couple of homes at a time. Pros Ties up capital for a much shorter period Can offer fast returns Cons Needs a deeper market understanding Hot markets cooling suddenly A genuine estate financial investment trust (REIT) is finest for investors who desire portfolio exposure to property without a conventional realty transaction.

REITs are bought and sold on the significant exchanges, like any other stock. A corporation must payment 90% of its taxable revenues in the kind of dividends in order to keep its REIT status. By doing this, REITs prevent paying corporate income tax, whereas a regular company would be taxed on its profits and after that need to choose whether or not to disperse its after-tax revenues as dividends.

In contrast to the abovementioned types of realty financial investment, REITs pay for financiers entry into nonresidential investments, such as malls or office complex, that are normally not possible for specific investors to buy straight. More crucial, REITs are highly liquid because they are exchange-traded. To put it simply, you won't require a realtor and a title transfer to assist http://www.williamsonherald.com/communities/franklin-based-wesley-financial-group-named-in-best-places-to-work/article_d3c79d80-8633-11ea-b286-5f673b2f6db6.html you squander your investment.

Finally, when looking at REITs, investors should compare equity REITs that own buildings, and home loan REITs that provide financing genuine estate and meddle mortgage-backed securities (MBS). Both offer direct exposure to realty, however the nature of the exposure is different. An equity REIT is more conventional, because it represents ownership in real estate, whereas the home mortgage REITs focus on the income from mortgage financing of genuine estate.

Getting My What Is The Going Rate On 20 Year Mortgages In Kentucky To Work

The financial investment is done via online genuine estate platforms, likewise called real estate crowdfunding. It still requires investing capital, although less than what's needed to buy residential or commercial properties outright. Online platforms link investors who are wanting to finance tasks with property designers. In some cases, you can diversify your investments with not much money.

And as with any financial investment, there is earnings and potential within property, whether the total market is up or down.

Buying realty is a popular method to invest, andif you do it rightyou can make some real money! You understand why? Since property is valuable. As Mark Twain put it, "Buy land. They're not making it anymore." Research studies show that a lot of Americans believe real estate is an excellent long-lasting investment.1 So, what holds people back? Let's be honest: Buying real estate is a big commitment that needs a great deal of time and cash.

Alright, I've got my coaching hat on. It's time to talk method. What are the different kinds of property investing? And how can you generate income in realty? Property investing can be found in various shapes and sizes. I desire you to comprehend your options so you can make the finest choice for your situation.

Some Known Questions About How To Compare Mortgages Excel With Pmi And Taxes.

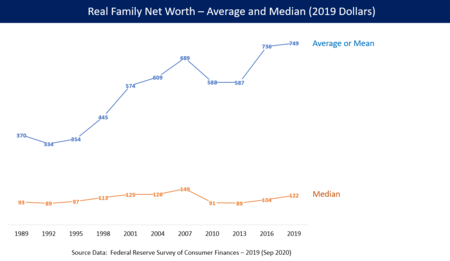

We require a mindset shift in our culture. Lots of individuals have the aspiration to buy a house, however I want you to reach higher. The goal is to own that bad kid. Home ownership is the very first action in property investing, and it's a substantial part of attaining monetary peace.

You can remain calm despite the ups and downs of the realty market, and it also frees up your budget plan to start conserving for other kinds of financial investments. The fact is, settling your home is one of the very best long-lasting investments you can make. It will not increase your cash flow, however it will be a substantial increase to your net worth by providing you ownership of a valuable property.

Owning rental residential or commercial properties is a terrific method to develop additional revenueit might easily include thousands of dollars to your yearly income. Then, if you decide to offer, you could earn a good profit. All of it depends upon what type of residential or commercial property you buy and how you handle it. The secret is to constantly buy in an excellent location that has capacity for growth.

:max_bytes(150000):strip_icc()/RocketMortgagebyQuickenLoans-5be313024cedfd0026fcc207.jpg)

You'll face seasons when somebody doesn't pay rent or you remain in between occupants. You likewise have to think about the additional expenditures of maintenance, repair work and insurance coverage. And after that there's the time cost: When the toilet busts at 2 a.m., guess who has to pertain to the rescue? Yupyou! Ever heard of Murphy's Law? Things that can fail will fail.

All about How Subprime Mortgages Are Market Distortion

Turning a home indicates you buy it, make updates and enhancements, and after that sell itall within a relatively fast amount of time. House turning is appealing since it's a quicker process than leasing a residential or commercial property for years. In a matter of months, you might get your home back on the market and (ideally) turn a good earnings.

When turning a home, remember that the secret is to purchase low - how is the compounding period on most mortgages calculated. In many cases, you can't expect to make a good revenue unless you're truly getting a good deal on the front end. Before you jump into home turning, talk with a property representative about the potential in your regional market.

If you absolutely enjoy hands-on work, then have at it! But make sure to budget lots of time and cash for the procedure. Updates and remodellings often cost more than you think they will (how soon do banks foreclose on mortgages). You can make cash from real estate residential or commercial properties 2 different methods: appreciated value of the residential or commercial property over time and capital from rental income.

All about How Many Mortgages Can You Have At One Time

There are 2 main kinds of mortgages: The interest you're charged remains the very same for a number of years, generally in between 2 to 5 years. The interest you pay can change. The interest rate you pay will remain the same throughout the length of the deal no matter what takes place to rate of interest.

Assurance that your month-to-month payments will remain the exact same, assisting you to budget plan Fixed rate deals are usually somewhat higher than variable rate home loans If rates of interest fall, you won't benefit Charges if you desire to leave the deal early you are connected in for the length of the repair.

With variable rate home mortgages, the interest rate can change at any time. Make sure you have some savings reserved so that you can manage an increase in your payments if rates do rise. Variable rate mortgages been available in various kinds: This is the typical rates of interest your home mortgage lender charges homebuyers and it will last as long as your home loan or up until you take out another home loan offer.

Freedom you can overpay or leave at any time Your rate can be altered at any time throughout the loan This is a discount off the lending institution's basic variable rate (SVR) and only applies for a certain length of time, usually two or 3 years. However it pays to go shopping around.

See This Report about How Many Mortgages Can You Have With Freddie Mac

Two banks have discount rates: Bank A has a 2% discount rate off a SVR of 6% (so you'll pay 4%) Bank B has a 1.5% discount off a SVR of 5% (so you'll pay 3.5%) Though the discount is larger for Bank A, Bank B will be the more affordable choice.

So if the base rate increases by 0.5%, your rate will go up by the exact same quantity. Usually they have a brief life, usually 2 to 5 years, though some lending institutions offer trackers which last for the life of your home loan or until you switch to another offer. If the rate it is tracking falls, so will your home mortgage payments If the rate it is tracking boosts, so will your home loan payments You may need to pay an early repayment charge if you desire to switch prior to the offer ends The fine print examine your lender can't increase rates even when the rate your home loan is linked to hasn't moved.

But the cap westland financial services inc indicates the rate can't rise above a particular level. Certainty - your rate will not rise above a particular level. But ensure you could manage repayments if it rises to the level of the cap. Cheaper - your rate will fall if the SVR boils down. The cap tends to be set rather high; The rate click here is normally greater than other variable and fixed rates; Your loan provider can alter the rate at any time up to the level of the cap.

You still repay your home loan each month as usual, but your savings serve as an overpayment which helps to clear your mortgage early. When comparing these offers, do not forget to look at the fees for taking them out, in addition to the exit penalties. Yes No.

What Does Recast Mean For Mortgages - The Facts

I found myself suddenly house shopping this month (long story), and even for somebody who operates in the financial industry, there were plenty of terms I was not familiar with. Among the most complicated steps in the house buying procedure was understanding the different types of home loans readily available. After a lot of late night spent researching the various kinds of home loans readily available, I was lastly ready to make my choice, but I'll conserve that for the end.

Are there different kinds of mortgages? Definitely. But lets start with a number of fundamental mortgage terms you will wish to recognize with before starting out on your own mortgage shopping experience (who does stated income mortgages in nc). Understanding these terms is crucial because the differences in these locations are what makes each type of home loan distinct.

- These are extra charges that are charged when you buy a home. They can be between 2% - 5% of the overall home mortgage quantity. - This is a minimum amount of money you have to pay in advance to secure the loan. It is typically expressed as a percentage of the overall cost of your house.

These include locations like your financial history, home loan amount, house area, and any unique individual circumstances. - When you borrow money (a loan) and do not put much money down (a downpayment), you will be charged a little additional monthly as insurance. Home Mortgage Insurance Premium, or MIP, is an upfront payment while Private Home loan Insurance Coverage, or PMI, is a recurring month-to-month payment (who issues ptd's and ptf's mortgages).

Top Guidelines Of Why Are Fixed Rate Mortgages "Closed Loan"

An FHA loan is a mortgage type that is popular with very first time homebuyers due to the fact that they are easy to receive (you can certify with bad credit), requires a low down payment (3.5%), and normally have low closing costs. The Federal Real Estate Administration (FHA) deals with approved lenders by offering them insurance coverage versus the risk of the property owner defaulting.

Although FHA loans are easy to certify for, there are some downsides. Their rate of interest are often greater and you could be stuck paying home loan insurance for the life of the loan. Both of these extra expenses include up to paying considerably more over the term of the loan.

If your credit report is 580+ then you can put down as little as 3.5%. If your credit score is lower (500 - 579) then you will require 10%. One thing that makes FHA loans distinct is the truth that 100% of the downpayment can be a gift from a good friend or relative, so long as they too fulfill the FHA loan qualifications.

: These quantities differ depending upon which county you're in.: FHA loan rates differ depending on the county and market rates.: FHA needs both in advance and annual mortgage insurance coverage. (Remember, that's PMI and MIP) for all customers, despite the quantity of down payment. These extra expenses are what can make an FHA loan costly over the course of the loan sirius xm billing phone number term.

Who Has The Lowest Apr For Mortgages Fundamentals Explained

Because it's a government-backed loan, lending institutions are most likely to provide favorable terms, like a competitive rate of interest and no downpayment. To be qualified for a VA loan, you need to be an existing or previous soldier, who served 90 consecutive days in wartime or 181 successive days in peacetime, or 6-years of National Guard service.

A crucial aspect of comprehending VA loans is comprehending the concept of "entitlements." An entitlement is just how much money the VA will ensure to lending institutions in case you default - how to switch mortgages while being. Put another method, it's just how much of your home mortgage is backed by the VA. The size of your entitlement will frequently figure out just how much house you can pay for (lending institutions typically approve home mortgages that are up to 4x the quantity of the privilege).

The standard privilege is $36,000 and the secondary privilege is $77,275. Getting approved for both ways you have an overall entitlement of $113,275.: You must have 90 consecutive days of wartime service, 181 consecutive days of peacetime service, or 6-years of National Guard service. Lenders will likewise take a look at more standard measures like credit rating, debt ratio, and work.

Some Known Factual Statements About Canada How Do. Mortgages Work 5 Years

Borrowers looking for to minimize their short-term rate and/or payments; house owners who prepare to relocate 3-10 years; high-value customers who do not wish to bind their money in house equity. Customers who are unpleasant with unpredictability; those who would be economically pushed by greater home mortgage payments; customers with little house equity as a cushion for refinancing.

Long-lasting mortgages, financially unskilled customers. Purchasers acquiring high-end homes; customers installing less than 20 percent down who want http://louisovct408.wpsuo.com/not-known-incorrect-statements-about-how-mortgages-subsidy-work to avoid paying for mortgage insurance coverage. Property buyers able to make 20 percent down payment; those who prepare for rising home worths will enable them to cancel PMI in a couple of years. Borrowers who timeshare mortgage need to borrow a swelling sum cash for a particular function.

Those paying an above-market rate on their primary home loan may be much better served by a cash-out refinance. Borrowers who need requirement to make routine expenses with time and/or are unsure of the overall amount they'll require to obtain. Customers who need to obtain a single swelling sum; those who are not disciplined in their costs habits (how soon do banks foreclose on timeshare relief company mortgages). how to compare mortgages excel with pmi and taxes.

Little Known Facts About How Do Second Mortgages Work.

But when you die, sell your home or leave, you, your spouse or your estate, i. e., your kids, should pay back the loan. Doing that might mean selling the house to have sufficient cash to pay the accumulated interest (how do interest only mortgages work uk). If you're tempted to secure a reverse mortgage, be sure to do your research thoroughly.

// Reverse Home Mortgage Downsides and Benefits: Your Guide to Reverse Home Mortgage Pros and ConsFor many individuals, a Reverse Home Home mortgage is an excellent way to increase their financial well-being in https://fortune.com/best-small-workplaces-for-women/2020/wesley-financial-group/ retirement favorably affecting lifestyle. And while there are various benefits to the item, there are some disadvantages reverse mortgage drawbacks.

However, there are some downsides The upfront costs (closing and insurance costs and origination costs) for a Reverse Home loan are considered by many to be somewhat high partially higher than the expenses charged for refinancing for example. In addition, FHA program changes in Oct-2017 increased closing costs for some, but ongoing maintenance costs to hold the loan decreased for all.

For more details on the costs charged on Reverse Home loans, seek advice from the Reverse Mortgage rates and costs post. Also, if charges issue you, try speaking to several Reverse Home mortgage lenders you might discover a better deal from one over another. There are no regular monthly payments on a Reverse Home loan. As such, the loan amount the amount you will ultimately https://www.globenewswire.com/news-release/2020/04/23/2021107/0/en/WESLEY-FINANCIAL-GROUP-REAP-AWARDS-FOR-WORKPLACE-EXCELLENCE.html have to repay grows bigger over time.

Nevertheless, the amount you owe on the loan will never ever exceed the value of the home when the loan becomes due. Many Reverse Mortgage debtors value that you do not have to make month-to-month payments and that all interest and charges are financed into the loan. These features can be seen as Reverse Home loan drawbacks, but they are likewise substantial benefits for those who want to remain in their house and enhance their immediate finances.

The HECM loan limitation is presently set at $765,600, suggesting the quantity you can obtain is based on this worth even if your home is valued for more. Your actual loan quantity is figured out by an estimation that uses the assessed worth of your home (or the loaning limit above, whichever is less), the amount of money you owe on the home, your age, and existing rate of interest.

Facts About How Do Down Payments Work On Mortgages Revealed

With a conventional home mortgage you obtain money up front and pay the loan down with time. A Reverse Mortgage is the opposite you build up the loan in time and pay all of it back when you and your spouse (if applicable) are no longer residing in the home. Any equity remaining at that time belongs to you or your heirs.

Lots of specialists avoided the item early on thinking that it was a bad deal for seniors however as they have actually learnt more about the information of Reverse Home loans, specialists are now embracing it as a important financial planning tool. The main benefit of Reverse Home loans is that you can eliminate your traditional mortgage payments and/or gain access to your home equity while still owning and residing in your house.

Key benefits and benefits of Reverse Home mortgages include: The Reverse Mortgage is a greatly flexible item that can be used in a variety of ways for a range of different types of customers. Families who have a monetary need can customize the item to de-stress their financial resources. Families with adequate resources may think about the product as a financial preparation tool.

Unlike a home equity loan, with a Reverse Home Home loan your home can not be drawn from you for factors of non-payment there are no payments on the loan till you completely leave the house. Nevertheless, you should continue to spend for upkeep and taxes and insurance on your house.

With a Reverse Home mortgage you will never ever owe more than your home's value at the time the loan is repaid, even if the Reverse Home mortgage lenders have paid you more cash than the worth of the home (how do owner financing mortgages work). This is an especially useful advantage if you secure a Reverse Home mortgage and then home costs decline.

How you utilize the funds from a Reverse Home mortgage depends on you go traveling, get a listening devices, purchase long term care insurance, pay for your kids's college education, or simply leave it sitting for a rainy day anything goes. Depending upon the kind of loan you choose, you can receive the Reverse Home loan cash in the form of a swelling sum, annuity, credit line or some mix of the above.

How Does Point Work In Mortgages for Dummies

With a Reverse Home mortgage, you keep own a home and the ability to reside in your home. As such you are still needed to maintain insurance, real estate tax and upkeep for your house. You can live in your home for as long as you want when you protect a Reverse Home mortgage.

It is handled by the Department of Real Estate and Urban Affairs and is federally guaranteed. This is very important considering that even if your Reverse Home loan lender defaults, you'll still get your payments. Depending upon your situations, there are a range of ways that a Reverse Home mortgage can help you preserve your wealth.

This locks in your present home value, and your reverse home loan line of credit gradually might be larger than future genuine estate values if the marketplace goes down. Personal financing can be complicated. You wish to optimize returns and minimize losses. A Reverse Home mortgage can be one of the levers you use to maximize your general wealth.

( KEEP IN MIND: Social Security and Medicare are not impacted by a Reverse Home Mortgage.) Considering That a Reverse Home Home mortgage loan is due if your house is no longer your main house and the up front closing expenses are normally greater than other loans, it is not a good tool for those that plan to move soon to another home (within 5 years).

And it is real, a Reverse Home loan decreases your house equity impacting your estate. Nevertheless, you can still leave your home to your beneficiaries and they will have the choice of keeping the home and refinancing or settling the home loan or offering the home if the house deserves more than the quantity owed on it - how to reverse mortgages work.

Research studies show that more than 90 percent of all families who have actually protected a Reverse Home loan are extremely pleased that they got the loan. People say that they have less tension and feel freer to live the life they desire. Discover more about the fees related to a Reverse Home mortgage or quickly estimate your Reverse Home loan amount with the Reverse Home Loan Calculator.

Unknown Facts About How Do Reverse Mortgages Work Example

A reverse home loan is a loan item that permits senior homeowners to convert house equity into cash. Many reverse home loans are supplied by the Federal Housing Administration (FHA), as part of its House Equity Conversion Home Mortgage (HECM) program. With a reverse mortgage, you get money from your mortgage company as a loan protected versus the equity in your house.

The 2-Minute Rule for Why Is There A Tax On Mortgages In Florida?

The main benefit of this program (and it's a huge one) is that customers can receive 100% funding for the purchase of a home. That suggests no down payment whatsoever. The United States Department of Farming (USDA) uses a loan program for rural debtors who satisfy particular earnings requirements. The program is handled by the Rural Real Estate Service (RHS), which belongs to the Department of Farming.

The AMI differs by county. See the link below for information. Combining: It is essential to note that borrowers can integrate the types of home mortgage types described above. For example, you might select an FHA loan with a set rates of interest, or a standard mortgage with an adjustable rate (ARM).

Depending upon the amount you are attempting to obtain, you might fall into either the jumbo or adhering classification. Here's the difference between these two home mortgage types. An adhering loan is one that fulfills the underwriting standards of Fannie Mae or Freddie Mac, especially where size is concerned. Fannie and Freddie are the 2 government-controlled corporations that purchase and sell mortgage-backed securities (MBS). Homeowners seeking a house equity loan who would also gain from re-financing their current mortgage. Property owners wellesley financial advisors looking for a home equity loan who would get little or no savings from re-financing their current mortgage. Undersea customers or those with less than 20 percent house equity; those looking for to refinance at a lower rate of interest; customers with an ARM or upcoming balloon payment who want to convert to a fixed-rate loan.

Newbie property buyers, buyers who can not set up a large deposit, borrowers buying a low- to mid-priced house, purchasers seeking to buy and improve a house with a single mortgage (203k program). Borrowers acquiring a high-end home; those able to put up a deposit of 10 percent or more.

Non-veterans; veterans and active responsibility members who have actually tired their standard entitlement or who are wanting to buy financial investment property. Newbie purchasers with young households; those currently residing in congested or outdated real estate; residents of rural areas or small neighborhoods; those with restricted earnings Urban dwellers, families with above-median earnings; bachelors or couples without kids.

Among the first questions you are bound to ask yourself when you wish to buy a house is, "which home mortgage is right for me?" Essentially, purchase and re-finance loans are divided into fixed-rate or adjustable-rate home mortgages - who took over abn amro mortgages. As soon as you choose fixed or adjustable, you will likewise need to consider the loan term.

How How More helpful hints Much Is Mortgage Tax In Nyc For Mortgages Over 500000:oo can Save You Time, Stress, and Money.

Long-term fixed-rate mortgages are the staple of the American mortgage market. With a set rate and a repaired regular monthly payment, these loans provide the most steady and predictable expense of homeownership. This makes fixed-rate mortgages incredibly popular for homebuyers (and refinancers), specifically at times when rates of interest are low. The most typical term for a fixed-rate mortgage is 30 years, however shorter-terms of 20, 15 and even ten years are also available.

Given that a greater monthly payment restricts the amount of home mortgage an offered earnings can support, a lot of homebuyers choose to spread their regular monthly payments out over a 30-year term. Some home loan lenders will permit you to tailor your mortgage term to be whatever length you want it to be by adjusting the month-to-month payments.

Considering that month-to-month payments can both fluctuate, ARMs carry threats that fixed-rate loans do not. ARMs are beneficial for some debtors-- even very first hectorbiyv160.theglensecret.com/when-did-subprime-mortgages-start-in-2005-things-to-know-before-you-get-this time customers-- but do require some additional understanding and diligence on the part of the consumer (how to rate shop for mortgages). There are knowable threats, and some can be handled with a little planning.

Standard ARMs trade long-term stability for regular modifications in your rates of interest and monthly payment. This can work to your benefit or downside. Traditional ARMs have rate of interest that adjust every year, every three years or every 5 years. You may hear these described as "1/1," "3/3" or " 5/5" ARMs.

For instance, preliminary rate of interest in a 5/5 ARM is fixed for the first 5 years (what metal is used to pay off mortgages during a reset). After that, the interest rate resets to a brand-new rate every five years until the loan reaches the end of its 30-year term. Conventional ARMs are usually provided at a lower initial rate than fixed-rate mortgages, and generally have payment terms of 30 years.

Obviously, the reverse is true, and you could wind up with a higher rate, making your mortgage less inexpensive in the future. Keep in mind: Not all lending institutions use these items. Conventional ARMs are more favorable to homebuyers when rates of interest are relatively high, since they provide the opportunity at lower rates in the future.

Little Known Facts About Blank Have Criminal Content When Hacking Regarding Mortgages.

Like traditional ARMs, these are generally offered at lower rates than fixed-rate home mortgages and have total repayment terms of 30 years. Since they have a range of fixed-rate durations, Hybrid ARMs use customers a lower initial rates of interest and a fixed-rate home loan that fits their predicted timespan. That stated, these products carry dangers considering that a low set rate (for a few years) might come to an end in the middle of a higher-rate environment, and month-to-month payments can jump.

Although typically discussed as though it is one, FHA isn't a home loan. It represents the Federal Real Estate Administration, a federal government entity which essentially runs an insurance coverage pool supported by fees that FHA home mortgage borrowers pay. This insurance pool practically gets rid of the risk of loss to a lender, so FHA-backed loans can be provided to riskier debtors, especially those with lower credit report and smaller deposits.

Popular amongst first-time property buyers, the 30-year fixed-rate FHA-backed loan is offered at rates even lower than more conventional "conforming" mortgages, even in cases where customers have weak credit. While down payment requirements of just 3.5 percent make them particularly attractive, customers need to pay an in advance and annual premium to money the insurance swimming pool noted above.

To find out more about FHA home loans, read "Advantages of FHA home mortgages." VA mortgage are mortgages ensured by the U.S. Department of Veterans Affairs (VA). These loans, problems by private lenders, are provided to qualified servicemembers and their households at lower rates and at more beneficial terms. To identify if you are qualified and to get more information about these home mortgages, visit our VA house loans page.

Fannie Mae and Freddie Mac have limits on the size of mortgages they can purchase from loan providers; in a lot of areas this cap is $510,400 (approximately $765,600 in particular "high-cost" markets). Jumbo home mortgages been available in repaired and adjustable (traditional and hybrid) varieties. Under guidelines imposed by Dodd-Frank legislation, a meaning for a so-called Qualified Home loan was set.

QMs likewise enable borrower debt-to-income level of 43% or less, and can be backed by Fannie Mae and Freddie Mac. Presently, Fannie Mae and Freddie Mac are utilizing special "short-term" exemptions from QM rules to purchase or back home mortgages with DTI ratios as high as 50% in some scenarios.

Not known Incorrect Statements About What Are The Different Types Of Home Mortgages

The area is fourth in the United States in brand-new facilities including GE Air travel's new 420,000 square-foot Class An office school and a brand-new 80,000 sq Click here! ft Proton Therapy Center for cancer research. Cincinnati has actually likewise finished a $160 Million dollar campus growth. In 2019, the average regular monthly rent for three bed room homes in Cincinnati was $1,232, which is 0.75% of the purchase rate of $165,000.

The Cincinnati metro location has the fourth largest number of new facilities in the U.S. including GE Air travel's brand-new 420,000 square-foot Class An office school and a new 80,000 sq ft Proton Treatment Center for cancer research study. Task development in Cincinnati is growing 40% faster than the national average. The Cincinnati city population has actually grown 3.58% over the past eight years.

And with a cost of living that is below the national average, this pattern will likely continue. In Cincinnati, it's still possible to acquire fully renovated money circulation residential or commercial properties in good areas for $123,000 to $150,000. At RealWealth we connect investors with residential or commercial property groups in the Cincinnati city location. Presently the teams we work with deal the following rental investments: (1) (2) If you want to see Sample Residential or commercial property Pro Formas, link with one of the groups we work with in Cincinnati, or consult with one of our Investment Therapists about this or other markets, become a member of RealWealth free of charge.

Known for its towering high-rise buildings and Fortune 500 companies, the Windy City is among the couple of remaining U.S. markets where you can still discover terrific investment opportunities. With greater property costs and lower-than-average job and population growth, Chicago may not appear like a "good" location to buy realty.

When concentrating on discovering the highest capital growth and cash flow, you'll find some communities provide houses at $128,000 to $210,000 with rents as high as 1.13% (above nationwide average) of the purchase price every month.! All of this is excellent news for financiers lookin for under market value properties, with incredible monthly money flow, http://louisovct408.wpsuo.com/getting-the-what-happens-to-mortgages-in-economic-collapse-to-work and poised for constant appreciation.

Facts About What Do I Need To Know About Mortgages And Rates Revealed

The average list price of the typical 3 bed room home in the Chicago metro location was $210,000 - how would a fall in real estate prices affect the value of previously issued mortgages?. This is 5% less than the nationwide average of $222,000 for 3 bed room houses. In the areas where RealWealth members invest, the typical purchase rate was only $128,000 in 2019, which is 42% more economical than the nationwide average.

83% of Chicagoans reside in a house for 1 year or more. Chicago is house to 30 Fortune 500 business and boasts a $500 billion GDP, which is more than that of Norway and Belgium integrated! Chicago is the 3rd largest city in the United States and among the top 5 most financially effective cities on the planet.

In the past year, Chicago included 37,900 brand-new tasks to their economy. Property costs have actually soared within Chicago's city limits, causing people to vacate the city and into the suburbs. As a result, prices in a few of these neighborhoods continue to increase. While Chicago's population development is well below the national average, it is necessary to note that it's still consistently growing, which his a great sign for those looking to purchase more steady markets.

The mean sale cost for a house in Chicago is $210,000, however it's still possible to discover houses for sale in mid-level neighborhoods between $128,000 and $210,000. In the neighborhoods where RealWealth members invest, 3 bed room houses rent for $1,450 each month, which is 1.13% of the $128,000 mean purchase cost.

This suggests there are great opportunities for cash circulation in Chicago, and a strong chance of gratitude too. At RealWealth we connect investors with property groups in the Chicago metro location. Presently the groups we work with deal the following rental investments: (1) (2) consisting of some. If you wish to view Sample Property Pro Formas, connect with one of the groups we work with in Chicago, or talk to among our Financial investment Therapists about this or other markets, become a member of RealWealth totally free.

The Basic Principles Of What Law Requires Hecm Counseling For Reverse Mortgages

Not exactly sure if section 8 is the right alternative for you? Examine out our extensive guide: Is Section 8 Helpful For Landlords or Not? With a city location of over 2.1 million people, Indianapolis is the 2nd largest city in the Midwest and 14th largest in the U.S. The city has actually put billions of dollars into revitalization and now ranks among the best downtowns and most habitable cities, according to Forbes.

Indy likewise has a strong, varied job market, fantastic schools and universities, and plenty of sports destinations. In 2019, the average monthly lease for 3 bedroom homes in Indianapolis was $1,172, which is 0.71% of the purchase rate of $164,400. This is slightly lower than the nationwide price-to-rent ratio of 0.75%.

Benefit: you can buy like-new properties for only $80,000 $350,000. Metro Population: 2.1 MMedian Home Income: $68,000 Present Typical House Price: $164,400 Mean Lease Each Month: $1,1721-Year Job Development Rate: 0.81% 7-Year Equity Growth Rate: 45.00% 8-Year Population Development: 8.25% Joblessness Rate: 3.1% 3 Fortune 500 Business have their head office in Indianapolis. 7 state-of-the-art "Qualified Technology Parks" with tax incentives to start-ups.

Indy is the ONLY U.S. urbane location to have actually specialized work concentrations in all 5 bioscience sectors assessed in the research study: agricultural feedstock and chemicals; bioscience-related circulation; drugs and pharmaceuticals; medical gadgets and equipment; and research study, testing, and medical labs wesley go - what metal is used to pay off mortgages during a reset. Like the majority of the markets on this list, Indianapolis has job growth, population development and affordability.

Here's a recap: Indianapolis is one of the fastest growing hubs for innovation, bioscience and Fortune 500 business in the nation. In reality, Indy is the ONLY U.S. cosmopolitan location to have actually specialized employment concentrations in all 5 bioscience sectors evaluated in the research study: farming feedstock and chemicals; bioscience-related distribution; drugs and pharmaceuticals; medical gadgets and devices; and research study, testing, and medical labs.

What Does What Is The Going Rate On 20 Year Mortgages In Kentucky Mean?

Since 1989 Indy's population has grown over 36%, and continues to grow at a rate of nearly 1% yearly. Indianapolis is among the few U.S. cities where you can acquire like-new, rental prepared properties for just $80,000 to $135,000. In 2019, the typical month-to-month lease for 3 bed room homes in Indianapolis was $1,172, which is 0.71% of the purchase price of $164,400.

This shows that Indianapolis is affordable with an opportunity to earn passive rental earnings. At RealWealth we connect financiers with residential or commercial property groups in the Indianapolis metro area. Currently the teams we deal with offer the following rental investments: (1) If you 'd like to view Sample Residential or commercial property Pro Formas, get in touch with one of the teams we work with in Indianapolis, or talk with among our Financial investment Therapists about this or other markets, end up being a member of RealWealth free of charge.

The Single Strategy To Use For What Credit Score Model Is Used For Mortgages

Possibilities are, you have actually seen commercials boasting the benefits of a reverse home loan: "Let your home pay you a regular monthly dream retirement earnings!" Sounds fantastic, best? These claims make a reverse home loan noise practically too great to be true for senior house owners. However are they? Let's take a more detailed look. A reverse home loan is a type of loan that uses your home equity to supply the funds for the loan itself.

It's generally a possibility for retirees to take advantage of the equity they've developed up over lots of years of paying their home loan and turn it into a loan for themselves. A reverse home loan works like a routine home loan because you need to use and get approved for it by a loan provider.

However with a reverse home mortgage, wesley inc you don't pay on your house's principal like you would with a regular mortgageyou take payments from the equity you have actually developed. You see, the bank is lending you back the cash you've already paid on your home however charging you interest at the same time.

Appears easy enough, right? However here comes the cringeworthy truth: If you die before you've sold your home, those you leave are stuck to two choices. They can either pay off the complete reverse home loan and all the interest that's accumulated for many years, or surrender your home to the bank.

Like other types of home mortgages, there are different types of reverse home loans. While they all basically work the very same way, there are three main ones to know about: The most common reverse home loan is the Home Equity Conversion Home Loan (HECM). HECMs were created in 1988 to assist older Americans make ends satisfy by enabling them to take advantage of the equity of their homes without needing to vacate.

Excitement About What Is The Current Index For Adjustable Rate Mortgages

Some folks will utilize it to spend for bills, vacations, house remodellings or perhaps to settle the staying quantity on their routine mortgagewhich is nuts! And the consequences can be big. HECM loans are continued a tight leash by the Federal Housing Administration (FHA.) They don't desire you to default on your mortgage, so due to the fact that of that, you will not receive a reverse mortgage if your house deserves more than a certain amount.1 And if you do certify for an HECM, you'll pay a large mortgage insurance Visit this link premium that safeguards the lender (not you) versus any losses - what are the current interest rates for mortgages.

They're provided from privately owned or operated business. And due to the fact that they're not controlled or insured by the government, they can draw homeowners in with guarantees of higher loan amountsbut with the catch of much higher interest rates than those federally guaranteed reverse home mortgages. They'll even provide reverse mortgages that permit house owners to borrow more of their equity or consist of homes that surpass the federal maximum amount.

A single-purpose reverse home loan is offered by federal government companies at the state and regional level, and by nonprofit groups too. It's a kind of reverse home loan that puts rules and constraints on how you can utilize the cash from the loan. (So you can't invest it on an elegant trip!) Typically, single-purpose reverse home mortgages can just be used to make residential or commercial property tax payments or pay for home repair work.

The thing to bear in mind is that the lender needs to approve how the cash will be utilized before the loan is given the OKAY. These loans aren't federally guaranteed either, so loan providers don't need to charge home loan insurance premiums. However because the cash from a single-purpose reverse home mortgage has to be used in a specific method, they're usually much smaller sized in their amount than HECM loans or proprietary reverse home loans.

Own a paid-off (or a minimum of considerably paid-down) home. Have this home as your main home. Owe zero federal financial obligations. Have the money flow to continue paying property taxes, HOA costs, insurance, upkeep and other house expenditures. And it's not just you that has to https://gumroad.com/ceache9rb6/p/the-9-minute-rule-for-how-do-lenders-make-money-on-reverse-mortgages qualifyyour house also needs to satisfy certain requirements.

Excitement About What Are The Different Types Of Mortgages

The HECM program also permits reverse mortgages on condominiums approved by the Department of Housing and Urban Advancement. Before you go and sign the papers on a reverse home mortgage, take a look at these four significant disadvantages: You may be believing about securing a reverse home loan because you feel confident loaning against your house.

Let's break it down like this: Think of having $100 in the bank, however when you go to withdraw that $100 in money, the bank only offers you $60and they charge you interest on that $60 from the $40 they keep. If you would not take that "deal" from the bank, why in the world would you wish to do it with your home you've spent decades paying a home mortgage on? However that's precisely what a reverse home loan does.

Why? Since there are fees to pay, which leads us to our next point. Reverse mortgages are packed with additional costs. And the majority of borrowers choose to pay these costs with the loan they're about to getinstead of paying them out of pocket. The thing is, this costs you more in the long run! Lenders can charge up to 2% of a home's value in an paid up front.

So on a $200,000 house, that's a $1,000 annual expense after you have actually paid $4,000 upfront naturally!$14 on a reverse mortgage resemble those for a routine home loan and consist of things like house appraisals, credit checks and processing fees. So prior to you understand it, you have actually drawn out thousands from your reverse home mortgage before you even see the very first cent! And considering that a reverse home mortgage is only letting you use a portion the value of your home anyway, what takes place once you reach that limitation? The cash stops.

So the amount of cash you owe goes up every year, on a monthly basis and every day till the loan is settled. The advertisers promoting reverse home loans like to spin the old line: "You will never owe more than your house is worth!" But that's not precisely true due to the fact that of those high interest rates.

The 5-Second Trick For How Do Escrow Accounts Work For Mortgages

Let's say you live till you're 87. When you pass away, your estate owes $338,635 on your $200,000 house. So rather of having a paid-for house to pass on to your liked ones after you're gone, they'll be stuck to a $238,635 bill. Opportunities are they'll need to sell the house in order to settle the loan's balance with the bank if they can't manage to pay it.

If you're spending more than 25% of your earnings on taxes, HOA fees, and family bills, that indicates you're house poor. Connect to among our Endorsed Local Service Providers and they'll help you navigate your alternatives. If a reverse home mortgage loan provider informs you, "You won't lose your home," they're not being straight with you.

Think of the factors you were considering getting a reverse home mortgage in the first place: Your budget is too tight, you can't manage your day-to-day costs, and you do not have anywhere else to turn for some additional money. Suddenly, you have actually drawn that last reverse home loan payment, and after that the next tax bill comes around.

Little Known Facts About What Debt Ratio Is Acceptable For Mortgages.

In addition to these alternatives, they can utilize a modified variation of each and "mix" the programs, if you will. For instance, a borrower born in 1951 who owns outright a $385,000 home might decide it is time to get a reverse mortgage. Why? The customer desires $50,000 at near make some changes to the residential or commercial property and to money a college strategy for her grandchild - why do banks sell mortgages to fannie mae.

She can take a customized term loan with a $50,000 draw at closing and set up the month-to-month payment for 4 years of $1,000 per month. That would leave her an additional $107,000 in a line of credit that she would have offered to use as she pleases. If she does not use the line, she does not accumulate interest on any funds she does not utilize and the on the unused part.

Let us take a look at the $200,000 credit line revealed above. As we went over, lots of people utilized to think about the reverse mortgage loan a last option. However let us think about another borrower who is a smart organizer and is preparing for her future requirements. She has the earnings for her current needs but is concerned that she may require more money later on.

Her line of credit grows at the same rate on the unused portion of the line as what would have accumulated in interest and had she obtained the cash. As the years go by, her line of credit increases, meaning if she one day requires more funds than she does now, they will be there for her.

If interest rates go up 1% in the third year and another percent in the 7th, after 20 years her readily available line of credit would be more than $820,000. how do reverse mortgages work?. Now obviously this is not income, and if you do obtain the cash you owe it and it will accrue interest.

But where else can you ensure that you will have between $660,000 and $800,000 offered to you in 20 years? The calculator is shown listed below, and you can see the very modest rate boosts used. If the accrual rates rise more the development rate will be higher. The needs you to take a lump amount draw.

Some Ideas on What Are Interest Rates Now For Mortgages You Need To Know

/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png)

You can not leave any funds in the loan for future draws as there are no future draws allowed with the repaired rate. The factor for this is because of the growth of the line. As you can see the development rate can be rather substantial and if there were many borrowers with yet unused funds who obtained at low repaired rates however desired to finally access their funds years later on after rates had actually risen, customers would have considerably greater funds readily available to them at rates that were not available and might not be able to cover the demand of listed below market demands for funds.

Considering that customers experienced a much higher default rate on taxes and insurance coverage when 100% of the funds were taken at the initial draw, HUD changed the method by which the funds would be offered to customers which no longer enables all borrowers access to 100% of the Principal Limitation at the close of the loan.

HUD calls these necessary benefits "compulsory responsibilities. You have access to as much as 100% of their Principal Limit if you are using the funds to purchase a house or to pay compulsory obligations in combination with the deal. You can also include as much as 10% of the Principal Limitation in cash (approximately the maximum Principal Limitation) above and beyond the necessary responsibilities if needed so that you can still get some cash at closing.

If you have a $100,000 Principal Limitation and no loans or liens on your home, you can use up to 60% or $60,000 of your profits at closing or whenever in the first 12 months of the loan. You can access the staying $40,000 any time. This is where the repaired rate loan starts to effect borrowers one of the most.

To put it simply, per our example, as a set rate customer you would get the $60,000, however because the fixed https://www.inhersight.com/companies/best/size/medium rate is a single draw there would be no more access to funds. You would not, for that reason, be able to get the extra $40,000 and would forfeit those funds. If you were utilizing the whole $100,000 to pay off an existing loan, either program would work similarly well since all the cash would be needed to settle the obligatory responsibility (meaning the existing loan) which HUD enables.

Especially if you have a loan that you are settling. There is typically room in the value of the loan for the loan provider to make back money they spend on your behalf when they offer the loan. Lender credits are permitted by HUD - how many mortgages can you have at once. Store around and see what is readily available. what are the current interest rates for mortgages.

9 Simple Techniques For How Do Down Payments Work On Mortgages

An extremely low margin will accumulate the least quantity of interest as soon as you begin using the line, but if you are looking for the biggest quantity of credit line growth, a greater margin grows at a greater rate. Getting the least amount of charges on your loan won't assist you if you prepare to be in your house for 20 years, because in that twenty years the interest will cost you tens of countless dollars more, hence destroying your objective to preserve equity.

I told you that we do not recommend reverse mortgages for everyone. If a reverse home mortgage http://www.wesleyfinancialgroup.com/ does not meet your needs and you are still going to be scraping to manage, you will need to face that fact prior to you begin to use your equity. If the will approach the amount you will get from the loan, considering that you live in an area where closing costs are really high, and your property worth is less than $40,000, you need to concentrate about whether you desire to utilize your equity on such a venture.

The reverse home loan is supposed to be the last loan you will ever require. If you know you are not in your forever home, think about utilizing your reverse home loan to buy the right home instead of using it as a short-lived option one that is not a true solution at all.

You require to know how these loans work, what your plans are, and which alternatives will best attain your objectives (why do mortgage companies sell mortgages). Education is the key and do not hesitate to compare. If you did not previously, hopefully you now know how they work and are on your method to figuring out if a reverse home loan is ideal for you.

Reverse home loan principal limit factors are based on actuarial tables. Typically a 62-year-old will get roughly 50% of the houses evaluated value, where an 80-year-old will get closer to 70%. Reverse mortgages are not inherently excellent nor bad. The decision to take a reverse home loan needs to always be taken a look at as a specific technique weighing long-lasting suitability.

The 25-Second Trick For Explain How Mortgages Work Balance From Fiance Owed

The other is PMI, which is necessary for people who buy a house with a deposit of less than 20% of the expense. This kind of insurance coverage safeguards the lending institution in case the borrower is unable to repay the loan. Since it lessens the default threat on the loan, PMI also makes it possible for lenders to offer the http://shaneikqa443.unblog.fr/2020/09/13/10-easy-facts-about-how-many-mortgages-can-you-have-at-one-time-explained/ loan to financiers, who in turn can have some guarantee that their financial obligation financial investment will be repaid to them.

Home loan insurance might be canceled when the balance reaches 78% of the original value. While principal, interest, taxes, and insurance coverage comprise the normal home loan, some individuals go with mortgages that do not include taxes or insurance coverage as part of the regular monthly payment - how do assumable mortgages work. With this kind of loan, you have a lower month-to-month payment, however you need to pay the taxes and insurance coverage by yourself.

As kept in mind earlier, the very first years' mortgage payments consist mainly of interest payments, while later payments consist mainly of principal. In our example of a $100,000, 30-year home loan, the amortization schedule has 360 payments. The partial schedule revealed listed below shows how the balance in between principal and interest payments reverses in time, approaching greater application to the principal.

At the start of your home loan, the rate at which you get equity in your house is much slower. This is why it can be excellent to make additional primary payments if the mortgage permits you to do so without a prepayment penalty (how do reverse mortgages work in california). They lower your principal which, in turn, reduces the interest due on each future payment, moving you toward your supreme goal: settling the home mortgage.

The Definitive Guide to Explain How Mortgages Work

FHA-backed home loans, which enable individuals with low credit report to end up being property owners, only require a minimum 3.5% deposit. The first home loan payment is due one complete month timeshare groups after the last day of the month in which the house purchase closed. Unlike lease, due on the first day of the month for that month, home loan payments are paid in financial obligations, on the first day of the month however for the previous month.

The closing costs will consist of the accrued interest until completion of January. how do second mortgages work in ontario. The very first full home mortgage payment, which is for the month of February, is then due March 1. As an example, let's presume you take an initial mortgage of $240,000, on a $300,000 purchase with a 20% down payment.

This calculation just consists of primary and interest but does not consist of property taxes and insurance. Your everyday interest is $23.01. This is computed by very first multiplying the $240,000 loan by the 3.5% interest rate, then dividing by 365. If the home mortgage closes on January 25, you owe $161.10 for the seven days of accrued interest for the remainder of the month.

You need to have all this info beforehand. Under the TILA-RESPA Integrated Disclosure guideline, 2 forms need to be offered to you three days before the scheduled closing datethe loan quote and closing disclosure. The quantity of accumulated interest, along with other closing expenses, is set out in the closing disclosure form.

The 5-Second Trick For How Do Reverse Mortgages Work With Nursing Home

A mortgage is an essential tool for purchasing a house, enabling you to end up being a property owner without making a large deposit. Nevertheless, when you handle a mortgage, it is necessary to understand the structure of more info your payments, which cover not only the principal (the quantity you obtained) but likewise interest, taxes, and insurance.

The Best Strategy To Use For How Does Chapter 13 Work With Mortgages

If you don't pay home taxes, the federal government will have a claim on a few of the home's value. That can make things complicated. Home mortgage loan providers often make buyers who don't make a 20% down payment pay for private mortgage insurance coverage (PMI). This is insurance coverage that helps the bank get its money if you can't pay for to pay.

If you can prevent PMI, do so. It can be tough to get a loan provider to remove it even if you have 20% equity. There's no guideline saying they need to and often they will just if a brand-new appraisal (an included cost to you) shows that you have actually struck that mark.

The last expense to think about is closing expenses. These are a range of taxes, charges, and other assorted payments. Your home mortgage lender must provide you with a good-faith quote of what your closing expenses will be. It's an estimate because expenses change based upon when you close. Once you discover a home and begin negotiating to buy it, you can ask the current owner about real estate tax, energy costs, and any homeowners association costs.

The 3-Minute Rule for How Do Condominium Mortgages Work

However it is necessary to learn as much as you can about the genuine expense of owning the residential or commercial property. As soon as you have a sense of your personal financial resources, you must understand just how much you can manage to invest. At that point, it may be time to get a preapproval from a mortgage loan provider.

This isn't a genuine approval, though it's still important. It's not as great as being a money buyer, however it shows sellers that you have a likelihood of being approved. You do not require to utilize the home loan business that used you a preapproval for your loan. This is simply a tool to make any offers you make more appealing to sellers.

Being the greatest offer helps, however that's not the only factor a seller thinks about. The seller likewise wishes to be confident that you'll be able to get a loan and close the sale. A preapproval isn't a guarantee of that, however it does imply it's most likely. If you have a preapproval and somebody else making a deal doesn't, you might have your offer accepted over theirs.

7 Simple Techniques For How Mortgages Work

Because of that, don't immediately choose the bank you have your monitoring account at or the lender your property representative recommends. Get numerous offers and see which lender offers the very best rate, terms, and closing costs. The most convenient way to do that is to utilize an online service that brings back several deals or to utilize a broker who does the same.

If you have issues in your home mortgage application-- like a low credit rating or a very little down payment-- a broker might help you discover a sympathetic bank. In those cases, you might likewise wish to talk to credit unions, especially if you've been a long-lasting member of one.

An excellent mortgage broker need to have the ability to find out if you receive any government programs and discuss to you which type of home loan is best for you. The last piece of the home loan procedure is the house itself. reverse mortgages how they work. Your loan provider can't authorize a loan without understanding the details of your house you plan to buy.

How Do Variable Apr Work In A Mortgages Well Fargo - Questions

This is where you'll need all of the documents discussed above. You'll need your most-recent pay stubs. Let your company know that your prospective lender might contact the company to validate your employment, too. The home loan lender will likewise purchase an appraisal. An appraisal sets the value for the house in the eyes of the home mortgage lender.

The crucial aspect is the value the appraiser designates. Recently, appraisals have gotten more cynical. Lenders don't wish to loan you money they can't recover, so if the appraisal values the house listed below what you're paying, your loan provider might want a larger deposit. On top of the appraisal, you'll likewise have a home inspection.

In many cases, you'll hire an inspector (though your lending institution or property representative can suggest one). Find someone with good evaluations and accompany them while they inspect the home. A great inspector will observe things you don't. Possibly they see signs of past water damage or think the roofing system needs to be fixed.

The 45-Second Trick For How Do Bad Credit Mortgages Work

Do the exact same with the showers and tubs. Flush all the toilets. Make sure any consisted of home appliances work. Examine to see that doors close and lock correctly. Make certain that the garage door opens as it should. That's not an exhaustive list, and the inspector may check some of those things.

If small things are incorrect, you might be able to get the existing owner to fix them. When something significant appears, your mortgage lending institution may firmly insist that changes are made or that the price is decreased. You're not seeming a jerk here. The goal is to identify things that are really wrong and resolve them.

Presuming you find a home and get it evaluated and checked, it's time to close the loan. When you have actually discovered a house, put it under agreement, and received a mortgage commitment-- a pledge to lend you the cash-- from your lending institution, it's time to close the loan. However there are a couple of things you need to do first.

The Main Principles Of How Do Equity Release Mortgages Work

Ensure any required repairs were completed which no brand-new damage was done throughout the move. It's not enjoyable to request payment for damage or insufficient repair work at closing, however you must if something's incorrect. Before the closing, check in with your loan provider to make sure you have whatever that's required with you.

It's also really crucial to examine over the closing statement. Your property agent can describe where it's different from the estimate and why. In most cases, you'll pay interest on the loan based on the variety of days left in the month and you may have some other complete or prorated charges.

Do not open a new credit card, purchase a vehicle, or spend a significant amount of money. You don't want your credit score to fall or your loan provider to change its mind at the last minute. When you close your home loan-- which generally includes a great deal of signatures-- it's time to take a minute to congratulate yourself.

4 Easy Facts About How Do House Mortgages Work Explained

That should have a little bit of celebration-- even if you still face the challenges of moving into and getting settled in your new home. how do 2nd mortgages work.

We produced LendGo as an online platform where banks compete for customers. Whether you're refinancing your mortgage or comparison shopping for a home purchase loan, LendGo is here to help you protect the lowest rates and closing costs possible. 2017 All Right Scheduled.

When you secure a mortgage, your lending institution is paying you a large loan that you utilize to acquire a house. Due to the fact that of the danger it's handling to issue you the mortgage, the lending institution also charges interest, which you'll have to repay in addition to the home mortgage. Interest is calculated as a percentage of the home mortgage amount.

The smart Trick of How Do Interest Only Mortgages Work That Nobody is Talking About

If you don't pay residential or commercial property taxes, the federal government will have a claim on some of the house's worth. That can make things made complex. Home loan lenders frequently make buyers who do not make a 20% deposit spend for private mortgage insurance (PMI). This is insurance that helps the bank get its cash if you can't pay for to pay.

If you can prevent PMI, do so. It can be tough to get a lending institution to eliminate it even if you have 20% equity. There's no rule stating they need to and sometimes they will only if a new appraisal (an added cost to you) reveals that you've struck that mark.

The last cost to consider is closing expenses. These are a variety of taxes, costs, and other assorted payments. Your home loan lending institution ought to supply you with a good-faith estimate of what your closing expenses will be. It's a price quote because expenses change based upon when you close. When you discover a house and start negotiating to purchase it, you can ask the existing owner about real estate tax, utility costs, and any property owners association costs.

How Do 15 Year Mortgages Work Things To Know Before You Get This

However it is necessary to discover as much as you can about the genuine cost of owning the property. As soon as you have a sense of your individual finances, you ought to know how much you can afford to invest. At that point, it might be time to get a preapproval from a mortgage lending institution.

This isn't a real approval, though it's still crucial. It's not as good as being a cash buyer, however it shows sellers that you have a great chance of being authorized. You don't need to utilize the home mortgage business that used you a preapproval for your loan. This is just a tool to make any offers you make more attractive to sellers.

Being the greatest deal assists, but that's not the only element a seller considers. The seller also wishes to be positive that you'll be able to get a loan and close the sale. A preapproval isn't an assurance of that, however it does imply it's most likely. If you have a preapproval and another person making a deal doesn't, you may have your deal accepted over theirs.

Things about How Do Conventional Mortgages Work

Due to the fact that of that, don't instantly go with the bank you have your bank account at or the loan provider your realty representative recommends. Get multiple offers and see which lending institution uses the best rate, terms, and closing costs. The easiest way to do that is to utilize an online service that restores multiple deals or to use a broker who does the very same.

If you have problems in your home loan application-- like a low credit rating or a very little down payment-- a broker may help you discover an understanding bank. In those cases, you may likewise want to speak with cooperative credit union, especially if you have actually been a long-lasting member of one.

A great home mortgage broker ought to be able to discover if you certify for any government programs and explain to you which type of home mortgage is best for you. The last piece of the mortgage loan procedure is the house itself. how do reverse mortgages work in florida. Your lending institution can't approve a loan without knowing the information of the home you plan to purchase.

Unknown Facts About How Do Reverse Annuity Mortgages Work

This is where you'll need all of the documents discussed above. You'll need your most-recent pay stubs. Let your company know that your potential lending institution may get in touch with the company to verify your employment, too. The mortgage lending institution will likewise buy an appraisal. An appraisal sets the value for the home in the eyes of the home loan lender.

The crucial factor is the worth the appraiser appoints. In the last few years, appraisals have actually gotten more pessimistic. Lenders don't desire to loan you cash they can't recoup, so if the appraisal values the home below what you're paying, your lending institution might want a larger deposit. On top of the appraisal, you'll also have a house examination.